If there is one investment option that has always been stable and reliable globally, it is real estate.

Despite recent economic downturns, Dubai has consistently offered many opportunities for beginners to enter the real estate market, achieve above-average returns, and diversify their investment portfolios.

Some experts suggest that, when done appropriately, real estate investing can be the highest-earning asset class in a portfolio.

This article will provide a comprehensive step-by-step guide on how to invest in real estate in 2024, key factors to consider, and the five best ways to explore as a beginner this year.

Every investment decision should start with a clear goal. Ask questions about the purpose behind your investment and define them.

Are you looking to generate rental income from your investment property? Or do you aim to benefit from the potential appreciation of property values over time?

Make sure they also follow smart principles and provide a clear roadmap to how to invest in real estate.

Selecting the right investment strategy is crucial as it directly impacts your potential returns, vulnerability, and overall experience in the Dubai real estate market. Here are the 05 best ways to invest in real estate in 2024. Make sure your strategy aligns with the goals defined and risk tolerance.

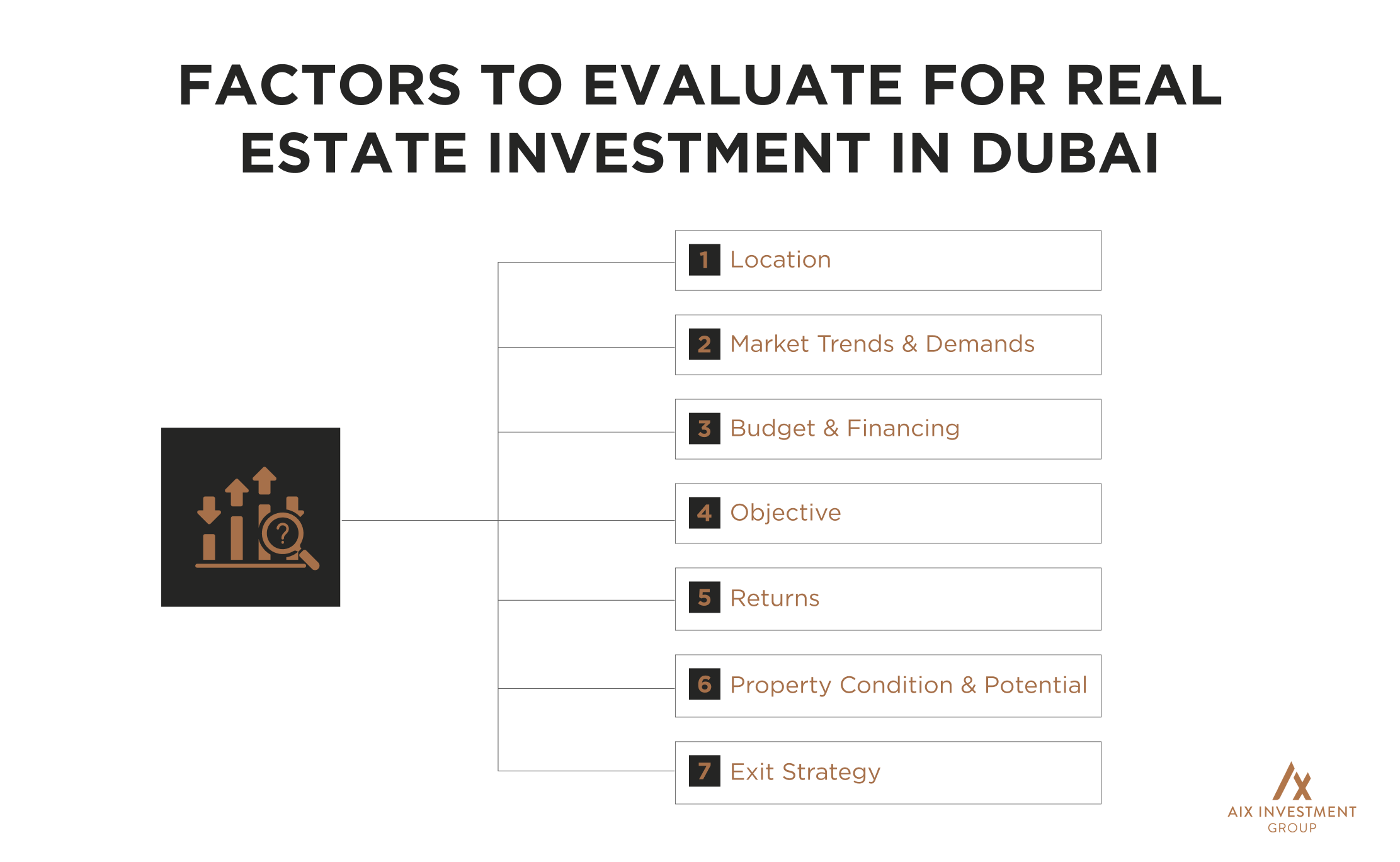

Once you have decided on a strategy, analyze the market trends, conditions, demand, and property value. Take into consideration factors such as neighborhood growth, valuations, economic indicators, and future development plans to make informed decisions about the best ways to invest in real estate.

Have a foolproof financing plan to support your investment decisions. Start by understanding your budget and what you can afford. Then, narrow down how to fund your investment. Common options include traditional mortgages, private loans, and cash purchases. Consider the terms and interest rates, and make sure the financial plan aligns with your budget, strategy, and timeline.

The return on your investment depends on the choice of the right property. Factors such as location, condition, valuations, potential for appreciation, and rental income all play a crucial role in maximizing your investment potential. Take the time to carefully view and assess properties based on your investment objectives.

A regulatory background check is a key step that should not be overlooked when you decide how to invest in real estate. Make sure to investigate the property and its legal status before making a purchase. Review title deeds, zoning laws, property inspections, and financial records. This goes a long way in ensuring transparency with pricing, and there are no costly surprises down the line.

Finalize the purchase by signing relevant contracts and completing all legalities. Confirm there is no room for sensitive errors and that you comply with all local regulations, depending on the nature of the real estate investment in Dubai.

The concept real estate investing for beginners and making wise choices has a lot to do with the right location. In fact, location is everything in Dubai real estate investment, as it has a direct impact on maximizing returns and property valuation.

Check for proximity to essential amenities, transportation hubs, schools, and job centres. Research the neighborhood, its future potential, and prospects to ensure they stand the test of time.

Notably, areas with relaxed zoning regulations, high-quality infrastructure, and social amenities are likely to be characterized as high investment returns in Dubai’s real estate markets.

How do you invest in real estate is a question that should be analyzed with a proper view of market trends and demands. A good market can maximize return potential, whereas an oversaturated one can reduce reliability with longer holding periods.

Once you have chosen a neighborhood, check the demand for specific property types. This insight allows you to invest in options that align with current and future market preferences.

Real estate investing for beginners involves many uncertainties and doubts. Proper budgeting and financing are crucial to keeping this journey as smooth as possible. Plan ahead on the cost you can allocate for your investment.

Find out how you plan to finance it and have a clear breakdown of payment strategies for the defined investment period. It is also highly recommended to pay off all debts before committing to an investment, as this can hinder financial flexibility and reduce the potential to maximize returns.

In Dubai, investment in real estate is a highly attractive prospect for both local and international investors. It is a versatile market with many opportunities for anyone willing to study, explore, and master it.

However, the key here is to have a clear objective that serves as the foundation to guide your choices. Do you want the property for self-use, buy and lease, or short or long-term objectives?

Asking yourself these questions helps you narrow down options and decide on the best ways to invest in real estate.

The only way to determine the profitability of your real estate investment is to understand the return ratio with risk tolerance and financial goals.

Strong return potential, whether through rental income, property appreciation, or both, is crucial to guarantee that your investment strategy generates long-term gains.

The returns could be periodic, for instance, on a monthly basis through rental income – or in full once a project is completed for a property built from the ground up and then sold.

Evaluating the projected returns of your investment decision also helps you understand cash flow, overall growth, and the success of your investment strategy.

Another crucial factor to consider when real estate investing as beginners is to see the condition and future potential of the property. This includes thoroughly assessing the structural integrity, maintenance requirements, renovations needed, and the capacity for value-adding improvements.

A successful real estate investment plan in Dubai should include a well-thought-out exit strategy that aligns with your financial goals and risk tolerance.

Common exit options for developers include:

Real estate bonds are a type of loan that provides funds for a borrowing account, often involving a government or corporate body. In other words, bonds are documents that perform as proof of loan between an investor and a corporation or government entity.

In a bond agreement, the investor gives the corporation or a government body a certain amount of money for a predefined period. In return, the investor, who is the lender, gets a periodic interest payment (outside the capital lent).

Once the agreed-upon time frame expires, the investor receives the capital or total amount paid from the borrower (corporation or government).

Real estate bonds work the same way. However, in this case, these bonds are backed by real property, commercial mortgages, or other real property debt. When you invest in real estate bonds, you lend out money to those related to real estate through REITs, exchange-traded funds, and real estate crowdfunding platforms.

The major benefits of investing in real estate bonds include but are not limited to the following:

As real estate bonds offer a fixed interest rate, they provide investors with the reliability of a steady income stream. This feature is particularly appealing to income-oriented individuals and retirees seeking a dependable source of passive income.

Unlike stocks and many other types of investment opportunities, bonds don’t fluctuate in value much. This means that the investors typically receive the same face value after maturity, which helps with capital preservation, assuming the issuer does not default.

Real estate is considered a hedge against inflation. Although this hedge is not as direct as owning a physical real estate, it offers a promising level of resistance against inflation.

Depending on the market conditions and the terms of the bonds, sometimes there is potential to see a capital appreciation. This often happens when the demand for a bond increases in the market.

Compared to stocks, bonds in general, including real estate bonds, exhibit lower volatility. These features make real estate bonds the best option for conservative investors.

Unlike stocks and other types of bonds that are tied to industries, real estate bonds perform differently, which increases their ability to reduce the overall portfolio risk.

If you are looking to invest in Dubai real estate immediately with little money, real estate investment trusts (REITs) can be the best option to consider.

Often compared to mutual funds, REITs are issued by public companies raising funds by selling shares of stock and issuing bonds and using this capital to purchase and lease out real estate such as office buildings, retail spaces, shopping malls, warehouses, apartments and hotels..

REITs tend to pay higher dividends, which makes them a very common option for retirement plans. If you don’t need a regular income, you can reinvest these dividends to grow your investment opportunities further.

These real estate investment trusts don’t feature the responsibility of owning properties physically. The management will handle the ownership and rental logistics related to the property. All you have to do is invest and collect your dividends, which is generally higher than stock-based investments.

However, it is important to remember that the type of REIT you purchase is a key factor that decides the amount of risk you will incur because non-traded REITs are quite difficult to sell and might be hard to value.

For this reason, new investors should generally stick to publicly traded REITs, which you can purchase through brokerage firms. You will only need a brokerage account for this purpose.

If you prefer to be exposed to a more diversified selection of real estate investment in Dubai, consider investing in a fund that has interests in many REITs. You can do this through a real estate ETF or by investing in a mutual fund that holds shares of multiple REITs.

Contrary to popular beliefs with real estate investment in Dubai, you don’t have to buy rental properties to maximize profits from property investments. This is where concepts like house flipping can be an alternative and sustainable option to your investment planning. In simple terms, flipping a house involves buying a discounted property, fixing or renovating it, and then selling it for a profit.

You need to make sure you are choosing the right properties in promising locations. This will allow you to turn a quicker profit than managing a property investment in Dubai.

To be a successful property flipper, you need the ability, knowledge, and skills to predict a property’s potential and have a vision for bringing it to life. Having sufficient cash, a reliable team of contractors, project organization skills, and accurate cost-estimating skills can also help you increase the likelihood of earning a profit from flipping properties.

As a general rule, remember that the sooner you can sell the property, the less time, money, and effort you will spend on holding costs, including mortgage payments, utilities, and other expenses related to insurance.

Besides that, if your home flipping strategy demands a lot of renovations, then it can carry extra risk and high out-of-pocket costs. Sometimes, you will also be required to obtain permits and do remodeling, which can cost more than you expect, especially if you hire contractors or outsource construction.

To reduce the cost and effort required to flip properties, always choose homes that don’t need major renovations in up-and-coming areas. As another effective strategy, you can consider renting the property while waiting for the home value to rise before selling.

Most importantly, learn the art of identifying attractive neighborhoods that will let you sell your purchases at a premium.

If you are looking to make a major commitment to Dubai real estate investment opportunities, then buying rental properties is a classic option. The major advantage of rental properties is that they offer a steady cash flow and have the possibility of appreciating over time- depending on the location.

Landlords can also deduct many of the costs associated with property management, such as maintenance, repairs, insurance premiums, utilities, mortgage interest, administrative fees, and depreciation.

There are two main ways to make money with rental properties.

Long-term rentals: These are properties you can rent for at least a year or longer. It assures a steady flow of cash, but it depends on the tenants being reliable as well. To make use of this option, you can choose between a multi-unit property or a single-family home.

This is targeted at rotating tenants who look to stay as short as one night, like Airbnb. If you are considering this option, you have the choice to list your entire home or apartment when you are away from the city or place, or you can simply buy an entire property meant only for short-term rentals.

The downside of this option is that it can be a time and energy-consuming investment that requires a high start-up cost. Landlords will have to deal with property damage, late payments, and unruly tenants.

You will also need to find and vet tenants, pay for ongoing maintenance or renovations, and deal with any other issues the tenants are facing. While you can reduce this burden by hiring a property management company, it can cut down your potential returns from rents.

Off-plan properties are another best way to invest in real estate in 2024, which has been attracting a lot of investors in recent times, primarily due to their reasonable price.

Off-plan properties are priced less than ready properties, making it a very convenient option for anyone starting on investment planning with a lesser amount. It also gives investors the prospect of property increasing in value near completion and handover.

This probability is high in Dubai, which is witnessing steady growth in the real estate sector. Investors can benefit from flexible payment plans with small down payments of only 10%. Some developers also offer installments for 4-5 years, which gives the benefit of renting out the property before starting to settle payments.

It allows investors to build their portfolios according to their cash flow capacity. Reputable developers also build communities that gain significant value as they mature, which increases the potential to benefit from higher returns.

However, it is also important to emphasize that any changes in the market can be expected and may affect the original value of the property. Likewise, off-plan projects have the potential risk of being canceled or delayed. This is why research on the developer is crucial when choosing off-plan property investment.

Experts believe rental properties, commercial real estate, and fix-and-flip projects are some of the best ways to invest in real estate in 2024, especially for those seeking high-profit potential.

Dubai has consistently upheld its reputation as the best country to buy property, and it continues to hold that position this year. Turkey, Stockholm, Australia, Portugal, Panama, Italy, and Medellin are the other countries that have stolen the spotlight for the best countries for real estate investment in 2024.

When considering dynamics for real estate investment in Dubai and globally, the market outlook for 2024 shows a healthy balance between demand-supply and regulatory policies. This has created a sustainable real estate environment with a surge in property prices, offering promising opportunities for investors. Property prices are unlikely to go down, at least until 2025.

Both options for real estate investment in Dubai have pros and cons. However, although they require a higher initial investment than apartments, villas have a significant potential for capital appreciation. As standalone properties, they often see better price growth over time, particularly in places undergoing rapid development.

Yes, you can own 100% of a property in Dubai, but it’s limited to designated freehold areas. In these zones, foreign investors are allowed full ownership of properties, including the right to sell, lease, or occupy them. However, outside these freehold zones, foreign ownership is restricted, and different regulations may apply.

At AIX, our seasoned professionals are here to guide you through the complexities of real estate investing as a beginner. Especially considering the dynamic landscape of the Dubai real estate market and its versatile options to benefit from, stepping into a decision requires careful planning and execution.

All our financial advisory services are personalized to your objectives, risk appetite, and budget. If you are contemplating investing in real estate in 2024 and need the right professional guidance, AIX will support you in every step.

You can talk to one of our financial advisors at +971 56 732 7222 or fill out our inquiry form, and we will get back to you at our earliest convenience.

Overview